Scaling Urban Agriculture: Beginning the Financial Sustainability Cycle

Financial Sustainability Series | Part 3: Building the System

With your vision & mission (why), value proposition (who benefits and how), resource needs (what it takes), and capital strategy (how to fund it), you now have the core of your business model. The next step is ensuring that business model can sustain itself over time. But financial sustainability isn’t static - it’s a cycle, strengthening your capacity over time, much like nutrient flows in a healthy ecosystem.

In the first post of this series, I introduced the financial sustainability cycle. Its components operate as interconnected flows:

1. Diverse funding streams – like biodiversity, diversity strengthens resilience.

2. Responsible stewardship of resources – managing capital as carefully as soil fertility.

3. Accountability – transparency that keeps the ecosystem in balance.

4. Effective management – tending and pruning for optimal health.

5. Efficient consumption of resources – minimizing waste.

6. Reserves and contingency plans – storing energy for lean seasons.

7. Reciprocity - Attracting and providing support to other members of the ecosystem.

In this post, I focus on the first four components: diversity, stewardship, accountability, and effective management and in the final post I’ll finish the cycle.

Created by Lynda Ramirez-Blust

Diverse funding streams

As the saying goes, don’t put all your eggs in one basket. Future availability of any funding source is never guaranteed. A government shutdown, shifting consumer preferences, a new local competitor, negative press, or a lack of product to sell can change everything. Relying on one or two streams puts your venture at risk. Diversifying funding streams means placing multiple eggs in multiple baskets. The goal is to create a portfolio – multiple funding sources that align with your business model and provide financial resources when you need them.

For for-profit enterprises, baskets might include:

product sales (with multiple products and outlets),

upgrades and add-ons,

professional services,

subscriptions with tiered levels or bundles.

For nonprofits, your buckets may include:

contributions (individuals, major donors, corporations),

grants (foundations, federal, state, and local government),

program service fees,

events,

membership dues,

rental income,

investment income.

Passive income is an often-overlooked opportunity to diversify, Yes, it can include high-yield savings or a CD – but it can also include:

licensing stock images from your operations,

royalties for a patent,

fees a toolkit or ‘how to’ guide,

commissions on advertising banners,

renting out underutilized space on a regular or occasional basis.

Passive income is like a perennial plant – an initial investment yield long-term, low-maintenance returns.

If you want to assess the diversity of your current income, list your most recent fiscal year funding sources. What percentage of total revenue does each bucket represent? Which category dominates? What are the threats and opportunities to that dominant funding stream? What opportunities exist to rebalance?

Responsible stewardship of resources

Business owners often focus heavily on financing – collecting and disbursing cash, granting and receiving credit, wooing investors, making investments, or securing loans and lines of credit – they avoid or delay the accounting. Accounting is the system of recording and summarizing business and financial transactions and analyzing, verifying, and reporting the results. Accounting is the core act of financial stewardship.

Investing in policies, processes, people, and technology to make it easier to record the financial activities of the organization is often seen as “overhead”, not worthy of attention, but this act of stewardship is critical to the health of the organization.

The balance sheet or statement of financial position tells you what you own (assets), what you owe (liabilities), and how much liquidity you actually have. It’s also where you consider unfunded liabilities – fixed assets that will need to be repaired or replaced and vacations that need to be paid out.

A rolling cash flow forecast tells you when cash will come in and go out. The earlier you see a potential shortfall the more options and time you have to take corrective action – speeding up receivables, delaying a payment, reducing spending, or using a line of credit.

The income statement or statement of activities shows you the revenue and expenses over time. When compared to another period (month, quarter, year) or to a budget, it can tell you whether you will be adding to your financial resources or depleting them.

Accountability

In our urban ecosystem, the local deer population has grown significantly in recent years. For the first time in twenty years, I saw a herd of deer browsing in our yard. With limited predators, the deer have expanded beyond what our forested wildlife corridors can sustain and migrated into urban streets and yards looking for food. Eventually, their numbers will decline because there is not enough food – nature’s way of enforcing accountability.

Financial sustainability requires a similar dynamic. Accountability - internally (to your board, team, or partners) and externally (to customers, donors, and community) – helps keep systems in balance. It builds on stewardship by turning financial into information in the form of dashboards, analysis, and evaluations that guide better decisions.

Effective Management

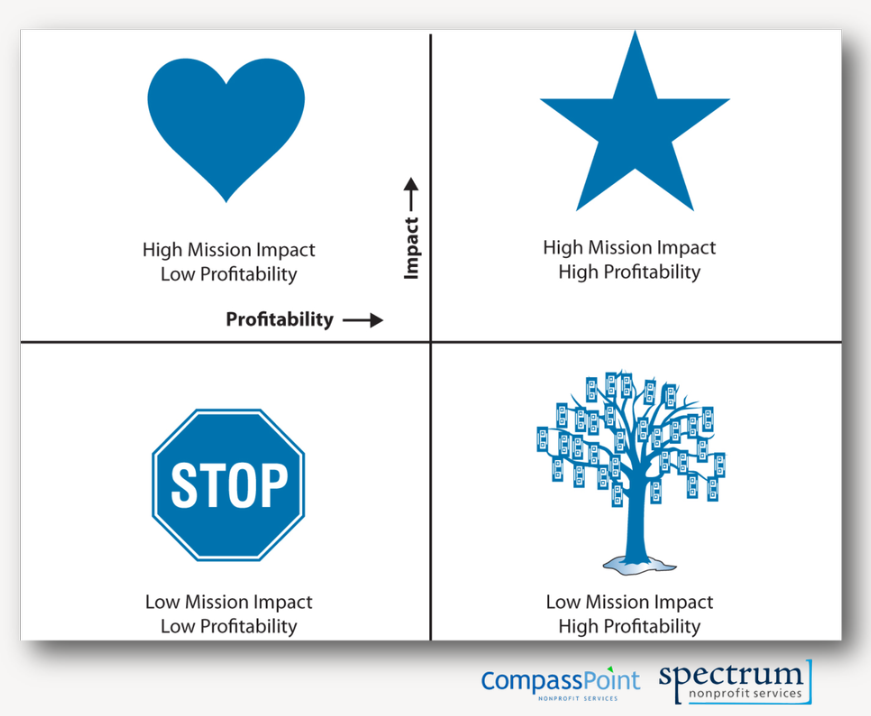

In Part 1 of this series, I shared the definitions of programmatic and financial sustainability written by authors Jeanne Bell, Jan Maaoka, and Steve Zimmerman in Nonprofit Sustainability: Making Strategic Decisions for Financial Viability. In the same book the authors offer a matrix map that frames metrics of sustainability along two dimensions – mission impact and financial outcomes. In summary of their model, when you consider these two dimensions together, you get four quadrants:

The Matrix Map from Nonprofit Sustainability: Making Strategic Decisions for Financial Viability.

Upper right quadrant – Stars: programs, projects, and initiatives to invest in and grow. They generate net revenue for the operations and have meaningful mission impact.

Upper left - Hearts – mission-aligned work that does not cover its costs. These require close monitoring and careful expansion only when offsetting revenue sources exist.

Lower right – Money Trees: passive or complementary funding streams that contribute to financial sustainability with limited direct mission impact.

Lower left – Prune: Activities that drain resources and should be re-evaluated, redesigned, or sunset.

Although designed for nonprofits, the framework applies equally well to social enterprises and mission driven for-profits.

Closing

In the final part of this series, we’ll explore the remaining components of the financial sustainability cycle – using resources wisely, building reserves for lean seasons, and cultivating reciprocity across the broader financial ecoystem.